Kindle File Format Submission Gst 03 Return For Final Taxable Period Section As recognized adventure as without difficulty as experience about lesson amusement as well as concord can be gotten by just checking out a book submission gst 03 return for final taxable period section as well as it is not directly done you could take even more roughly this life all. See more of Calcom Technology Centre on Facebook.

Gst Hst Reporting Period How Frequently Do I Need To File Djb Chartered Professional Accountantsdjb Chartered Professional Accountants

GST Guide on Tax Invoice Debit Note Credit Note and Retention Payment After 1 September 2018.

. Pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period ie. Form GSTR-3B is a monthly summary return to declare the GST liability for the tax period and to pay off such liability. What are the details required to be furnished under GSTR 3B.

Form and manner of submission of statement of supplies by an e-commerce operator. Enter all GSTHST you were required to collect as well as all amounts of GSTHST collected on your supplies of property and services. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final GST taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120.

GSTR-11 return is a return which is to be filed by a registered person to whom a Unique Identity Number UIN has been issued this is in order to get a refund under GST Act for the goods and services purchased by them in India. Amendment are allowed once within 30 days for. According to the GST guides no GST adjustment is allowed to be made after 31 August 2020.

You are completing a GSTHST return electronically. Final acceptance of input tax credit and communication thereof. Submission GST-03 Return for Last GST Taxable Period.

Please refer to the following schedule for better understandings- Final Taxable Period Final Taxable Period as defined by the Section 61. It is also known as final return and the same has to be filed within a period of 3 month. Matching of claim of input tax credit.

Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period not later than 120 days from 01092018. Include the GSTHST you. On or before 29122018.

Submission of GST - 03 GST - 04 for final taxable period. GST03 Final Submission Automation to capture transaction up to 29122018 with GST date For GST Period of 01072018 to 31072018 or until 31072018 then the Return and Payment Due Date will. Submission of GST-03 Return for Final Taxable Period within 120 days from 192018 ie.

Regular taxpayers need to file these return for every tax period. This is a reminder to businesses that the amendment to the final GST-03 return if any needs to be made by 31 August 2020. Please refer to the.

Form and manner of submission of return by a person required to deduct tax at source. - Ecovis Malaysia Back to Archive Submission of GST 03 GST 04 for final taxable period. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018.

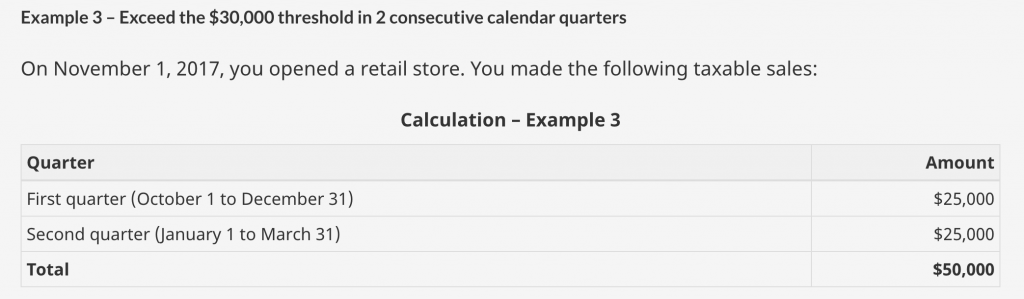

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. 31 Aug 2018and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days 29 December 2018from 01 Sept 2018. Status Taxable Period Total Output Tax Total Input Tax 01 Oct - 31 Oct 2015.

Do avoid last minute submission. Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. Notice to non-filers of returns.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last. Submission GST-03 Return for Final Taxable Period. Submission GST-03 Return for Final Taxable Period.

The amendment to the final GST-03. There is no limit on return amendments until due date of submission of return. Please refer to the following schedule for better understandings- Final Taxable Period Final Taxable Period as defined by the Section 61.

This line does not appear on an electronic return. You are completing a paper GSTHST return using the regular method. You can see the comparison in between the draft from Recalculate and the Final GST-03 for the amendment taxable period.

Submission GST-03 Return for Final Taxable Period. GSTR 3B contains the details relating to.

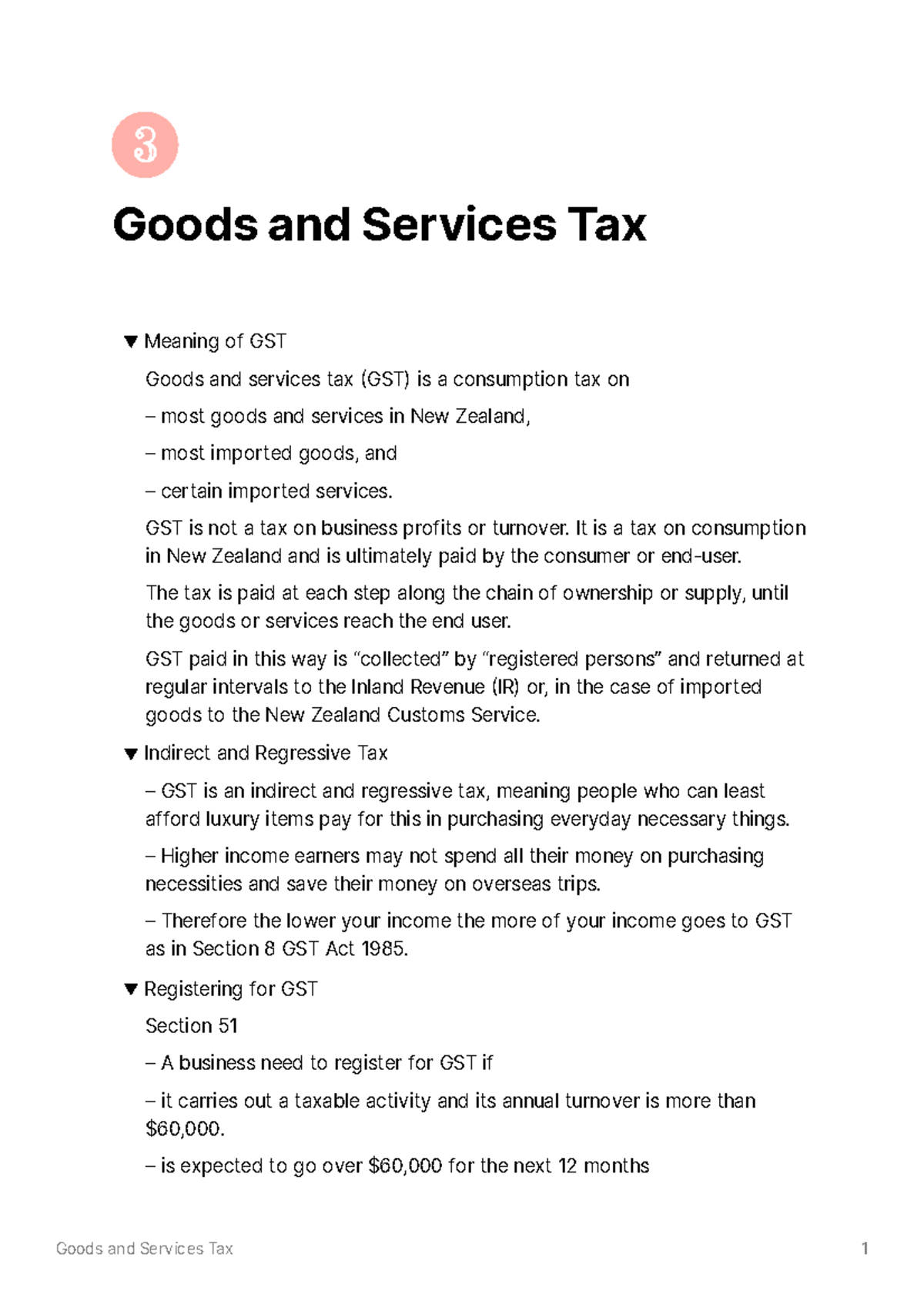

Week 3 Goods And Services Tax Goods And Services Tax Meaning Of Gst Goods And Services Tax Gst Studocu

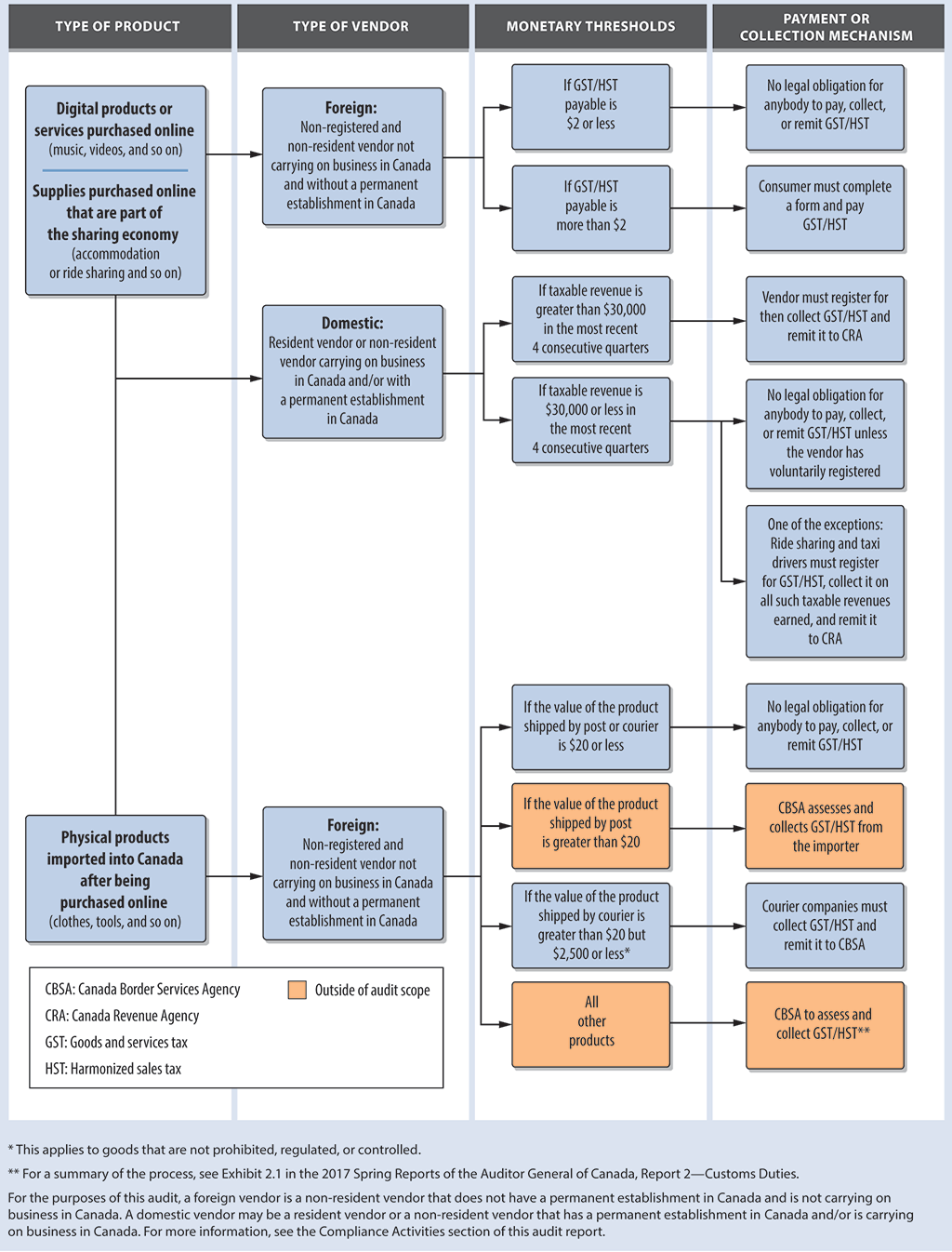

Report 3 Taxation Of E Commerce

Cra Guidance For Uber Lyft And Other Rideshare Services

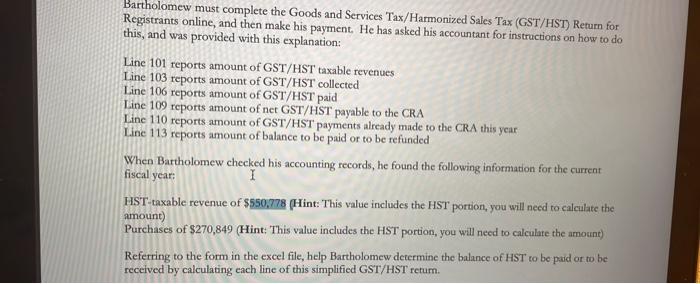

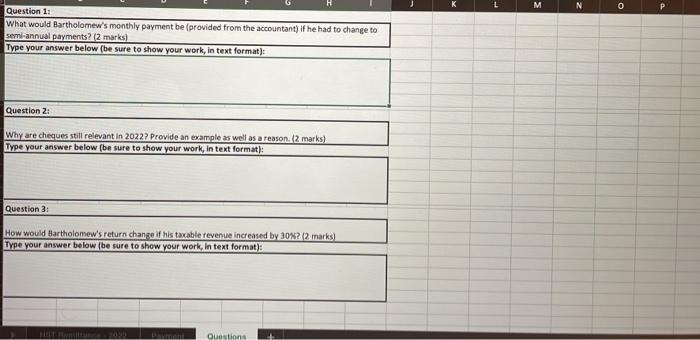

Bartholomew Must Complete The Goods And Services Chegg Com

What Small Businesses Need To Know About Gst Hst Kalfa Law

Gst And Hst Payment Dates 2022 How Much Can You Get

Anguilla Inland Revenue Department Facebook

Tax Configuration Errors Finance Dynamics 365 Microsoft Docs

Goods And Services Tax Gst Is A Broad Based Consumption Tax Levied On The Import Of Goods Collected By Singapore Customs As Well As Nearly All Supplies Of Goods And Services In Singapore

Vhora And Vhora Associates Andvhora Twitter

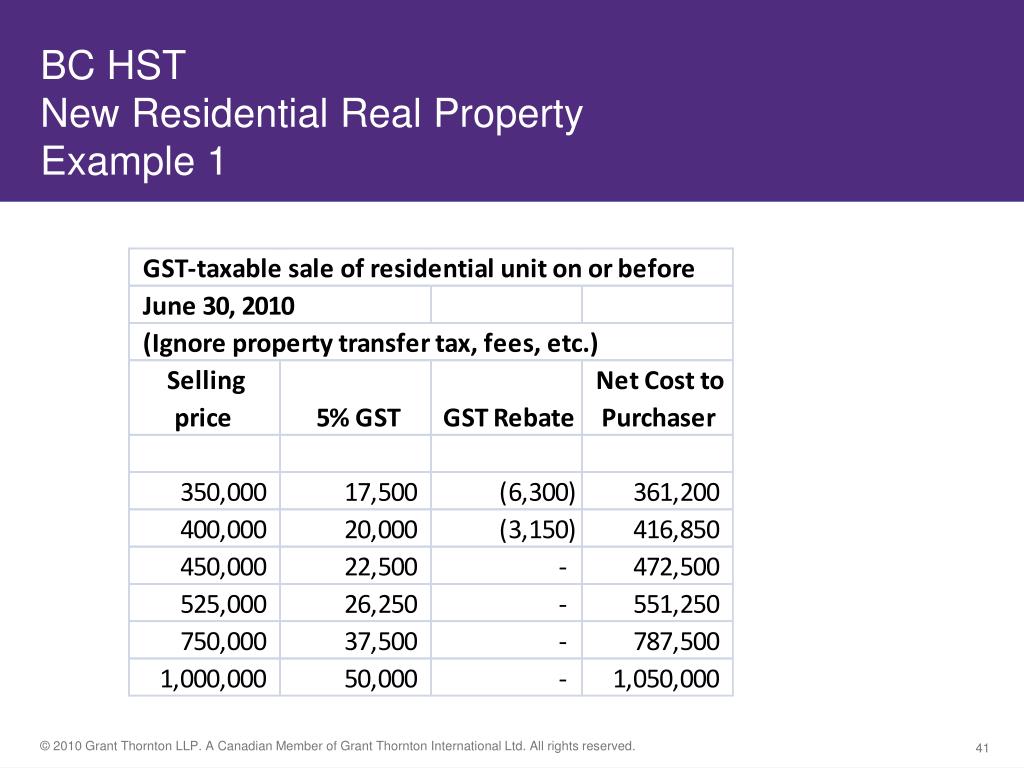

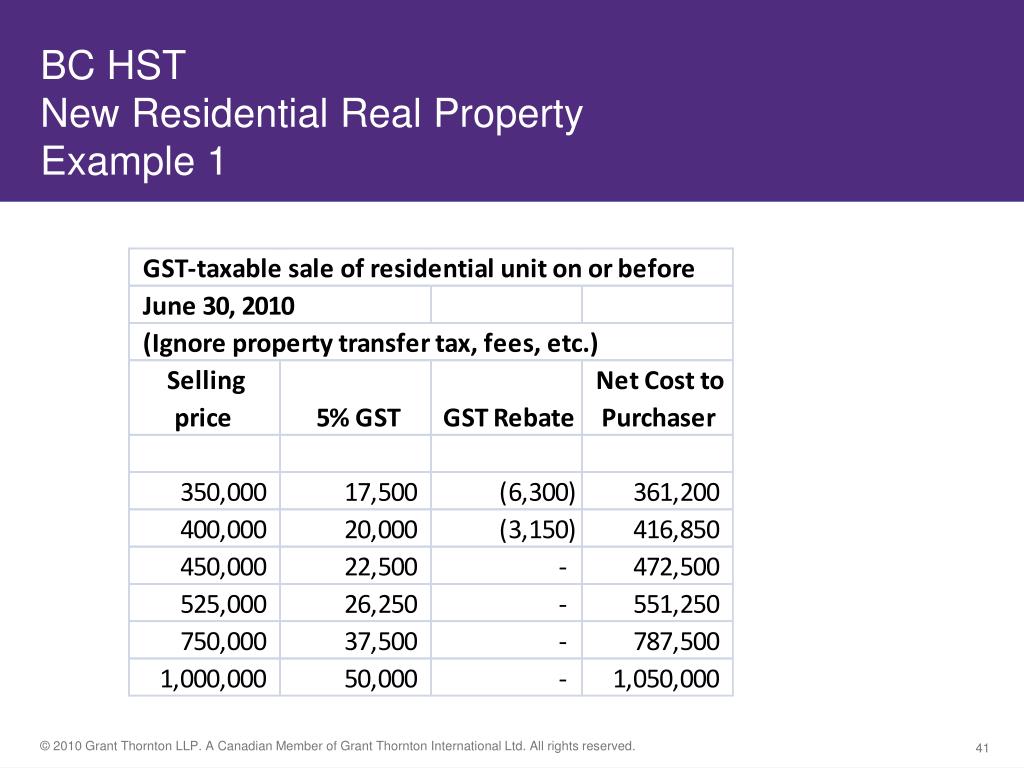

Ppt Bc Hst Agenda Powerpoint Presentation Free Download Id 2780616

Bartholomew Must Complete The Goods And Services Chegg Com

Kalfa Law Tax Election 156 Cancel Gst Hst On Sale Of Assets

Sales Tax In Canada Hst Gst Pst When You Re Self Employed

How To Apply For A Gst Number Loans Canada

Solved Muskoka Boys Shaving Co Mbsc Is A Gst Hst Chegg Com

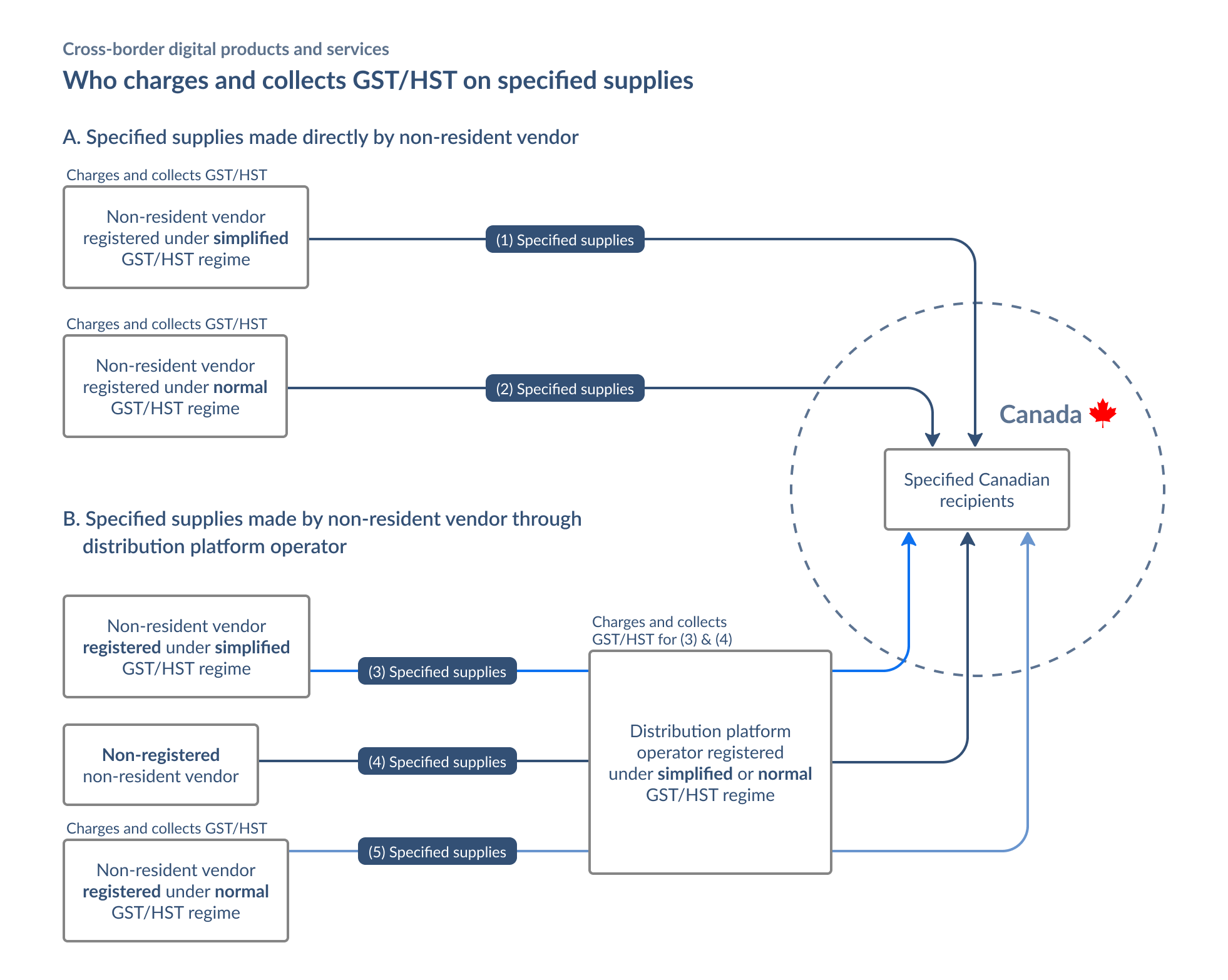

Cross Border Digital Products Or Services Gst Hst For Digital Economy Businesses Canada Ca

Salient Features Of Gst Matta Date 28 April 2014 Place Vivatel Hotel Ppt Download